Throughout 2021, NFTs in the shape of zoo animals wearing gaudy jewelry took hold of Internet culture. Despite the excitement, worries about the environmental impact, the ponzi-esque nature of many NFT projects, and the growing culture of profiteering in the NFT space started to spread like wildfire.

This relatively mundane technology, pierced through society, economics, and politics is bringing forward a very heated discussion on whether or not this technology is harmful. I believe that NFTs have been shown in an overly negative and skeptical light. This article is designed as a well researched retort to such claims, and also shows how NFTs can be used positively within the video game industry.

The Environmental Impact of NFTs

During the NFT craze of 2021, it felt as if my entire Twitter feed was commenting on the negative environmental impact of NFTs. The thesis of this argument is quite simple; NFTs run on blockchains, every time you make an NFT transaction the blockchain consumes fossil fuels, these fossil fuels hurt the environment. This argument couldn’t be further from the truth. The first misunderstanding relates to how blockchains operate.

Of the most popular blockchains, only two operate using the consensus method proof-of-work (Bitcoin and Dogecoin), the remainder use proof-of-stake. Proof-of-work has computers, crunch numbers, to decide who chooses what is to be added to the blockchain (Wackerow et al., 2022). Proof-of-stake uses an algorithm to pick, at random, what validator choses what is added to the blockchain (Smith et al., 2022), a system that consumes 99.95% less energy than a similar proof-of-work blockchain (Wackerow et al., 2022). Images of warehouses full of large machines consuming obscene amounts of energy are quite jarring, but of the two remaining popular blockchains that use proof-of-work neither of them support NFTs. What caused this false narrative about NFT energy consumption?

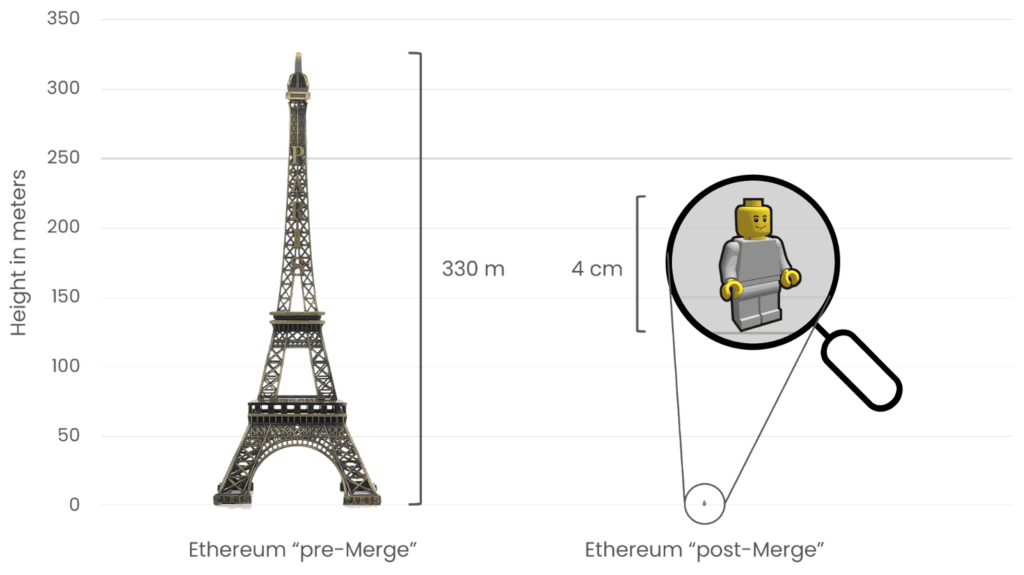

On September 15th, 2022, Ethereum moved from being proof-of-work to proof-of-stake. Similar to changing out the engine of a cargo jet carrying billions of dollars mid flight this update had taken years to deliver. Despite the developers best efforts, Ethereum was still Proof-of-Work during the NFT mania. The conclusion now is that NFT energy consumption was a problem, but now the problem seems to be solved. This is still false, NFT energy consumption has never been a problem, people believed it was a problem due to a misunderstanding of how the consensus mechanism on a blockchain works.

Miners take part in confirming blocks because they make money doing so, the more money to be made, the more miners take part increasing energy consumption. Therefore, the energy consumption of NFTs is equal to the percentage of revenue these transactions make for miners.

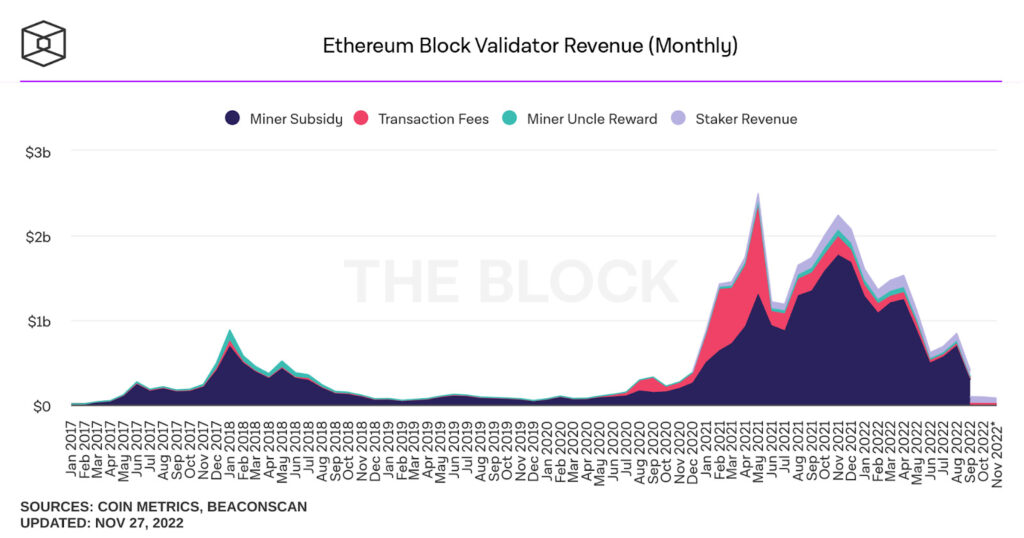

Ethereum miners made money from three sources of which one is negligible. The remaining two are block reward and fee revenue. Looking at the graph below it’s clear that since 2017, Ethereum miners have made the majority of their money from the miner subsidy. This is new Ether created that’s given to those who mine a block. The second largest revenue source is transaction fees. This is Ether paid by users to have their transaction added to the blockchain, this is where the profits from NFT transactions are derived from.

Opensea, which made up over 90% of all NFT transactions (DappRadar, 2022), reported 102,000 NFT transactions on August 30th (DappRadar, 2022). The Ethereum network as a whole reported 1.2 million total transactions in the same month (Etherscan, 2022). During August 30th, total Ethereum transactions generated 11.8% of the total miner revenue, and of that only 8.5% of these transactions were NFTs on OpenSea.

Only 1% of miner revenue was derived from NFTs on OpenSea during the 2021 mania, and therefore NFTs should only account for 1% of all Ethereum energy consumption. Of the 23 million megawatt hours consumed per year by Ethereum (Crypto Carbon Ratings Institute, 2022) only 230 thousand megawatts can be attributed to NFT transactions. For reference in 2019 Google used 12.4 terawatt hours (Bryce, 2020). On top of this, after the merge this energy consumption has dropped by a further 99.95%.

NFTs as a Tool for Ponzi Schemes

NFTs are non-fungible tokens used to represent ownership of unique items (Ethereum.org, 2022). This is a concept that already exists in the real world. A deed to a house is unique in that all houses are unique. It is non-fungible because it’s very hard to sell a portion of a house. NFTs bring this concept to a blockchain. Properties of well designed blockchains include decentralization, giving these networks near perfect uptime. Auditability, allowing anyone to verify information, and immutability, making the information hard to corrupt or change. When living abroad I saw first hand how systems without these properties cause harm.

I lived through the ‘08 financial crisis in Dubai that was made worse by the bank’s inability to audit loans customers had already received from other banks. I lived in Indonesia where Islamic finance stops people from receiving modern and adequate financial products. I lived in Cameroon where many people are completely unbanked. NFTs are a tool to take already existing non-fungible and unique financial products, such as mortgages and certificates, and put them on a layer that anyone with a computer and Internet connection can access, build on, and audit.

Before this technology, all digital files could be copied ad-infinitum. Using NFTs, the file itself can be copied but the token of ownership can’t. In the same vein, someone can photocopy the deed to a house, but that doesn’t make them the owner. One of the most popular use cases of NFTs is profile picture projects, or pfp projects. These projects usually create 1000 to 10,000, somewhat unique pictures all under a similar theme to be used as profile pictures on applications like twitter. The most popular and most valuable during the 2021 rise was Bored Ape Yacht Club or BAYC, these are the famed monkey pictures.

BAYC was unique, as it was the first major NFT project to leverage the status symbol found in other scarce products. This bears resemblance to luxury watches, a fancy car, or a house in the right part of town. None of these items do what they are supposed to do very well. Expensive Rolexes don’t keep good time, fancy cars aren’t fuel efficient, houses in Mayfair are less spacious, and BAYC is a very rudimentary implementation of NFT technology.

All of these non-fungible assets have risen in value despite the only discernible use case being bragging rights. They hold their value only because more people want these status symbols. There is an argument to be had that these are examples of ponzi-schemes. More entrants need to enter the space to return value to already existing investors, but to then conclude that all watches, cars, and houses are simply a pawn in an elaborate ponzi-scheme would be absurd.

NFTs as a Tool for Video Games

Explaining all the possible futures of how NFTs are to be used would be largely speculation, and would fit better in a book. One future that has been made quite clear over the past few years is NFTs in video games.

Throughout my childhood I ended up moving country every 2–3 years. One of the great ways I could keep in touch with friends was through video games, a type of media controlled by centralized entities. If these entities create poor updates to the game or stop running the game entirely, the friendships I had could start to fade and the time I spent ranking up and collecting items could disappear. NFTs can serve as a tool to bring these games to a decentralized, auditable, and immutable layer that can live on far longer than any individual company or IP.

I will always have a soft spot for trading card games, from Pokemon in my youth to Hearthstone later on. These games are all very similar: users collect cards and fight them in a digital arena. Building a better deck of cards and knowing how to use it is key to consistent victory. These games suffer from a mix of different incentives. The companies who make the IP only care about the underlying game so long as it leads to greater sales of their cards. They don’t make money from people playing the game, this is in fact just a cost in AWS servers.

Turning these cards into NFTs and allowing anyone to build on this IP would lead to a cambrian explosion of creativity. Anyone anywhere can build any type of game on top of this IP. They can then profit off of this IP by appealing to a monetizable player base by producing their own IP, creating a digital marketplace or selling their games for a set fee. Players now get more games to play, smaller creators can now build on top of IP and capture an existing monetizable player base, and the original creators of this IP can now sell their IP to a much larger audience playing many more games. An example of this is already being built on a game I have sunk many hours into called Gods Unchained by a team in Australia called ImmutableX.

NFTs don’t need to be just digital collectibles, they can also serve as a universal reputation system. Cheating in chess is very easy, an open source AI called Stockfish is able to beat the best players comfortably. Large platforms and tournaments can invest in strong anti-cheat, but smaller firms can’t. The chess ranking system is also opaque, with players usually having different rankings on different sites. For example, my current ranking on chess.com is 500, but my lichess.com ranking is 960.

Cheaters jumping from platform to platform and players having different ranks on each site can both be solved using NFTs and the creation of a universal reputation system that is linked to your Ethereum wallet. Large sites could create NFTs with metadata that outlines users reputation on one site that could include ranking and whether or not they had cheated. Users could take that with them to play anywhere, both in the real and the digital world. Creating a fairer and more auditable environment for players. These tokens can be untradeable, and the place they were minted from can be easily audited stopping players from forging or buying reputation.

Reflecting on the past and future of NFTs

The reader may be surprised about how NFTs actually operate, the number of negative articles on NFTs is overwhelming, and many are unfair or plainly inaccurate. In a broader sense I have noticed a trend of techno-skepticism developing in the western world. The negative coverage around 5G towers and MRNA vaccines are streamed to Fox News viewers, on phones using 5G to receive the information by journalists who are fully vaccinated. It would be naive to assume NFTs would be any different.

I can understand a fear of something as invasive as a vaccine, even if this fear is unreasonable, but a fear of NFTs due to BAYC would be similar to a fear of pdfs because someone used the technology to digitally store “Mein Kampf”.

I have been using NFTs almost since their creation. I can remember using crypto-kitties in 2017 and being excited to use one of the first decentralized applications built on a blockchain despite how basic it was. I’m now personally blown away by all of the different ways in which this technology has been used. It seems as if there isn’t enough time in the day to experience them all. Contrasting the experience I have had with NFTs, and what many people have heard about the technology from the media, it couldn’t be more different. The people that operate within these communities care deeply about the environment, and building social goods that are net benefits to society. Many of the people in this space describe themselves as “solar punks”, which is a set of beliefs that prioritize building sustainable, open, protocols for anyone to freely use, similar to public healthcare and libraries. These beliefs are so strongly held that they played a large part in convincing me of the importance of this digital future.

Conclusion

NFTs aren’t advancing the climate crisis, and they aren’t a tool designed for ponzi-schemes. It’s a file format that can be used to build decentralized and open protocols. This can be seen in many video games using the technology today, and in many ways that video games can use this technology in the future.

References

Wackerow, P. et al. (2022) Proof-of-work (POW), ethereum.org. Ethereum Foundation. Available at: https://ethereum.org/en/developers/docs/consensus-mechanisms/pow/ (Accessed: November 28, 2022).

Smith, C. et al. (2022) Proof-of-stake (POS), ethereum.org. Ethereum Foundation. Available at: https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/ (Accessed: November 28, 2022).

Wackerow, P. (2022) Ethereum Energy Consumption, ethereum.org. Ethereum Foundation. Available at: https://ethereum.org/en/energy-consumption/ (Accessed: November 28, 2022).

Ethereum.org (2022) The Merge. Ethereum Foundation. Available at: https://ethereum.org/en/upgrades/merge/ (Accessed: November 28, 2022).

The Block. (2017) The block – the first and final word in digital assets. Available at: https://www.theblock.co/data/on-chain-metrics/ethereum/ethereum-miner-revenue-monthly (Accessed: November 28, 2022).

DappRadar. (2022) Top ethereum marketplaces, DappRadar. Available at: https://dappradar.com/rankings/protocol/ethereum/category/marketplaces (Accessed: November 28, 2022).

DappRadar. (2022) Dapp Radar Marketplaces: OpenSea. Available at: https://dappradar.com/ethereum/marketplaces/opensea (Accessed: November 28, 2022).

Etherscan.io. (2022). Ethereum Daily Transactions Chart. Available at: https://etherscan.io/chart/tx. (Accessed: November 28, 2022).

Crypto Carbon Ratings Institute. 2022. The Merge – Implications on the Electricity Consumption and Carbon Footprint of the Ethereum Network. Crypto Carbon Ratings Institute.

Bryce, R. (2020). How Google Powers Its ‘Monopoly’ with Enough Electricity for Entire Countries. Available at: https://www.forbes.com/sites/robertbryce/2020/10/21/googles-dominance-is-fueled-by-zambia-sze-amounts-of-electricity/ (Accessed: 28 November 2022).

Ethereum.org. (2022). Non-Fungible Tokens (NFT). Available at: https://ethereum.org/en/nft/ (Accessed: 28 November 2022).

I’ve created a start-up, Grown Folks 502 and I have ideas utilizing NFTs and blockchain technologies in the retail cannabis industry. I’m new to Computer Science but not to great ideas and I’m putting in the sweat equity and little monies I have into proving my concept. I’m reading, “Computer Science Distilled” and I have a crate of other books to get started. Thank you!